Table of Contents

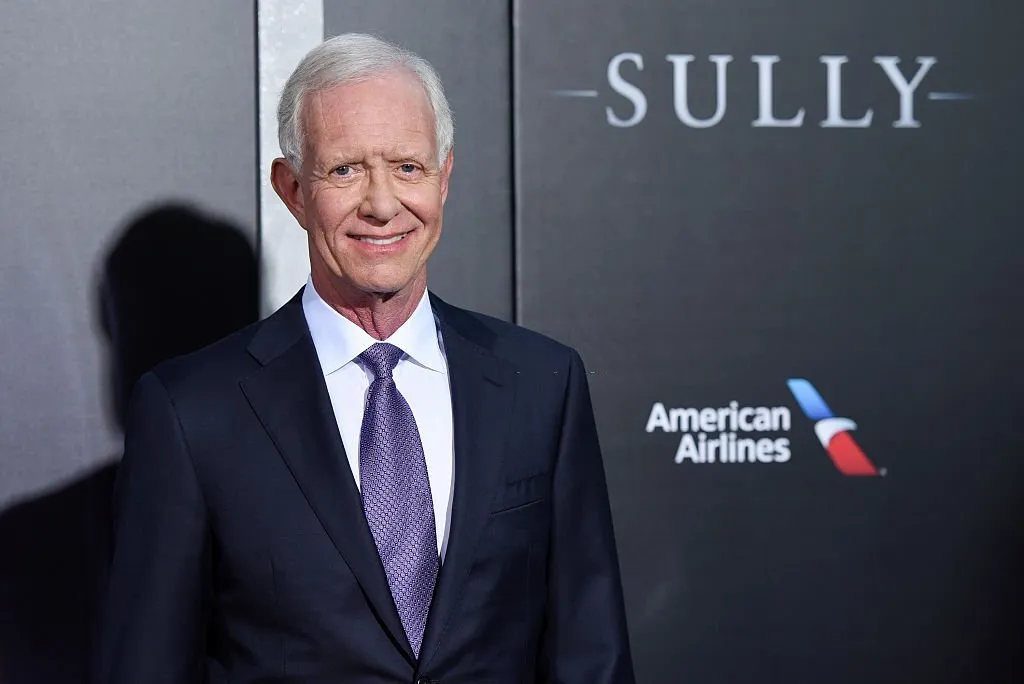

Discover the truth behind Why did Sully lose his pension in this comprehensive article. Uncover the reasons behind his financial struggles and gain valuable insights.

In the realm of personal finance, stories of individuals facing adversity often teach us valuable lessons. One such tale is that of Sully, whose pension was lost, leaving him in a kingdom of monetary turmoil. In this text, we are able to delve into the info of Why did Sully lose his pension and explore the reality behind his economic struggles. Join us in this journey as we uncover the key factors that led to his unlucky state of affairs.

Why did Sully lose his pension?

The Initial Setback

Sully’s pension troubles began with an unexpected medical emergency. This unforeseen event led to mounting medical bills and forced him to dip into his retirement savings. It’s a stark reminder of the importance of having a robust emergency fund in place.

Job Loss and Economic Downturn

During the economic downturn, Sully faced the unfortunate reality of losing his job. This sudden unemployment, coupled with dwindling savings, pushed him further into financial instability. The job market’s unpredictability can affect anyone, emphasizing the need for a diversified financial portfolio. Click to read slow is smooth and smooth is fast.

Misguided Investments

Sully’s investment decisions played a significant role in his financial woes. He made ill-advised investments without proper research, resulting in substantial losses. This underscores the importance of seeking professional financial advice and making informed investment choices.

Lack of Pension Diversification

Sully’s reliance on a single pension plan left him vulnerable when it faced financial troubles of its own. Diversifying one’s retirement portfolio can help mitigate risks and provide stability during challenging times.

Table of Why did Sully lose his pension:

| Question | Answer |

|---|---|

| Why did Sully lose his pension? | Sully lost his pension because US Airways, the airline he worked for, went bankrupt twice. When a company files for bankruptcy, it can terminate its pension plan and the Pension Benefit Guaranty Corporation (PBGC) takes over. The PBGC guarantees a certain level of benefits, but they are often lower than what retirees would have received under the company’s original plan. |

| Did Sully do anything wrong to lose his pension? | No, Sully did nothing wrong to lose his pension. He was a highly respected pilot with an impeccable safety record. The loss of his pension was simply a consequence of the airline industry’s financial struggles. |

| Was Sully the only pilot to lose his pension? | No, many pilots lost their pensions as a result of airline bankruptcies. In fact, the PBGC has paid out billions of dollars to retirees from failed airlines. |

The Truth Behind Sully’s Struggles

Limited Financial Education

Sully’s lack of financial knowledge hindered his ability to make informed decisions. Investing time in learning about personal finance is crucial for long-term financial well-being.

Neglecting Retirement Planning

Sully did not prioritize retirement planning until it was too late. Starting early and consistently contributing to retirement accounts is essential to building a secure financial future.

Coping with Debt

Accumulating debt further exacerbated Sully’s predicament. Managing debt responsibly is essential to maintain financial stability and avoid long-term consequences.

Insufficient Emergency Fund

Sully’s inadequate emergency fund left him vulnerable to unexpected expenses. Building an emergency fund should be a top priority to handle life’s uncertainties.

Lack of Professional Guidance

Sully’s reluctance to seek advice from financial experts contributed to his financial downfall. Consulting with professionals can provide valuable insights and strategies to secure one’s financial future. Read also Unblocked Games 6x.

Final Words

Sully’s story serves as a cautionary tale, highlighting the importance of financial education, diversification, and prudent decision-making. Understanding the reasons behind his pension loss empowers us to make informed choices and secure our financial futures. By learning from Sully’s mistakes, we can avoid similar pitfalls and build a path to financial stability.

FAQs about Why did Sully lose his pension

What is the importance of diversifying my pension plan?

Diversifying your pension plan reduces the risk of losing your retirement savings if one investment option underperforms. It ensures stability and better financial security in the long run.

How can I start building an emergency fund?

Start by regularly saving a portion of your income in a separate account. Try to save enough to cover three to six months of living expenses.

Why is financial education essential for financial stability?

Financial education equips you with the knowledge and skills needed to make informed financial decisions, manage debt, and plan for retirement effectively.

What should I do if I face unexpected medical bills?

If you encounter unexpected medical bills, consider negotiating with healthcare providers for reduced fees and setting up a manageable payment plan. It’s also crucial to review your health insurance coverage.

Is it too late to start retirement planning if I’m in my 40s or 50s?

It’s never too late to begin retirement planning. While starting early is ideal, making consistent contributions to retirement accounts and seeking professional guidance can still yield positive results.

How can I find a reliable financial advisor?

To find an honest financial marketing consultant seeking tips from buddies or own family, take a look at their credentials and evaluations, and make certain they have got your satisfactory hobbies in mind.